By GUEST BLOGGER: Peter Worrell

As an entrepreneur owner-manager, do you ever wonder, “Hmm…will I ever get this business to achieve a wealth creation event, someday? It sure would be nice to think that all of the passion, effort, and sweat, not to mention cash I have risked in this business, would result in a capital gain where I could get some serious chips off the table, and get out of my day-to-day responsibilities. Now that would be a great goal to achieve.” Wouldn’t it?

Or would it? For seasoned, successful owner-managers, does the fun and flourishing in life come from achieving goals or striving for goals? Can the entrepreneur’s life arc mature to the point that you achieve a wealth building transaction, and then possibly take another step forward into a whole new arc of achievement? We believe it can. Yet, virtually every friend/client of ours has underestimated just how much upheaval, sense of loss, change in role, potential loss of purpose, and confusion of identity can happen after an owner-manager achieves a successful wealth creation transaction. And the identity change isn’t usually merely the owner-manager—it is often an identity change for the entire family. An owner-manager’s whole community of relationships will change. These are issues to be taken seriously. It is hard work and it’s challenging but it’s worth it to be painfully honest with yourself now, to think through issues in advance that will so unmistakably affect the future quality of your long life.

What we are saying is this: since medical technology is changing at an exponential rate, it’s likely you will live a long time—much longer than you thought. If you are 45 or 50, you may just be reaching middle age. Literally. The old concept of freedom from work, having no work to do, has been a persistent ideal throughout human history. Yet Aristotle said the two most prevalent causes of human misery are these: one, not having the right sort of work to do that calls upon one’s abilities and develops oneself; and two, having time on one’s hands to kill or burn. The happy individual then, in the Aristotelian definition, is one who enjoys the work he is doing, and has no time to kill or burn. This is consistent with our experience—for an owner-manager to have a successful capital gain transaction, he must have clarity on what he will be striving for in the next chapter. Why? Because, if the capital gain is the “end of striving,” could that be the end of fun, the end of wellbeing? It has to be seen as the end of this chapter of striving and now the owner-manager’s attention and energy properly goes to the next chapter of striving for purpose and meaning.

In finance, the difference between the future value and the present value is known as “discount.” In psychology, the difference between where you ideally want to be in your life compared to where you are today is called “discrepancy.” Regardless of whether you think discount or discrepancy, do you have a plan for what the next chapter will look like for you personally and how it will advance you towards where you want to be? If so, great. But if not, it is essential to have one before embarking on an engagement to capture a capital gain. Experience shows if you are prepared for the “Simultaneity of the Personal Transition and the Professional Transaction”, your stress will decrease markedly and this clarity of insight will influence your decision making to an outcome that is ultimately in your best interest.

————————————–

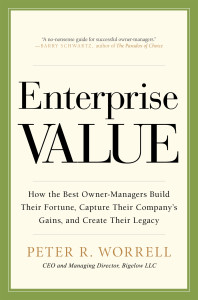

Here is more info on Mr. Worrell’s new book:

If you want to have a capital gain and a positive legacy someday, what are the half dozen actions you should take right now?

So many of the people we meet are true experts in what they do. But when the time comes to realize a capital gain, many entrepreneurs find themselves thrust out of their comfort zone into the realm of the private transaction market. All the thoughtfulness, fearlessness and leadership they’ve exercised throughout the process of building a successful company does nothing to help lead them down this new path. The business aspect of this kind of transaction is difficult enough to understand and navigate. But then there is the psychology of it all. How do you make the right decisions that not only provide the highest quality of wealth but also the right decision that leads to positive legacy, for both you and for those to whom you are handing your life’s work?

These questions – along with a myriad of others entrepreneurs ask or need to ask as they consider a capital gain event – are reflected upon, and ultimately answered by author Pete Worrell in this book. Worrell artfully illustrates the psychology involved in creating the legacy of a company and how best to handle the “passing of the torch”.

But it on Amazon or Barnes & Noble!